#Flood insurance rate map manual

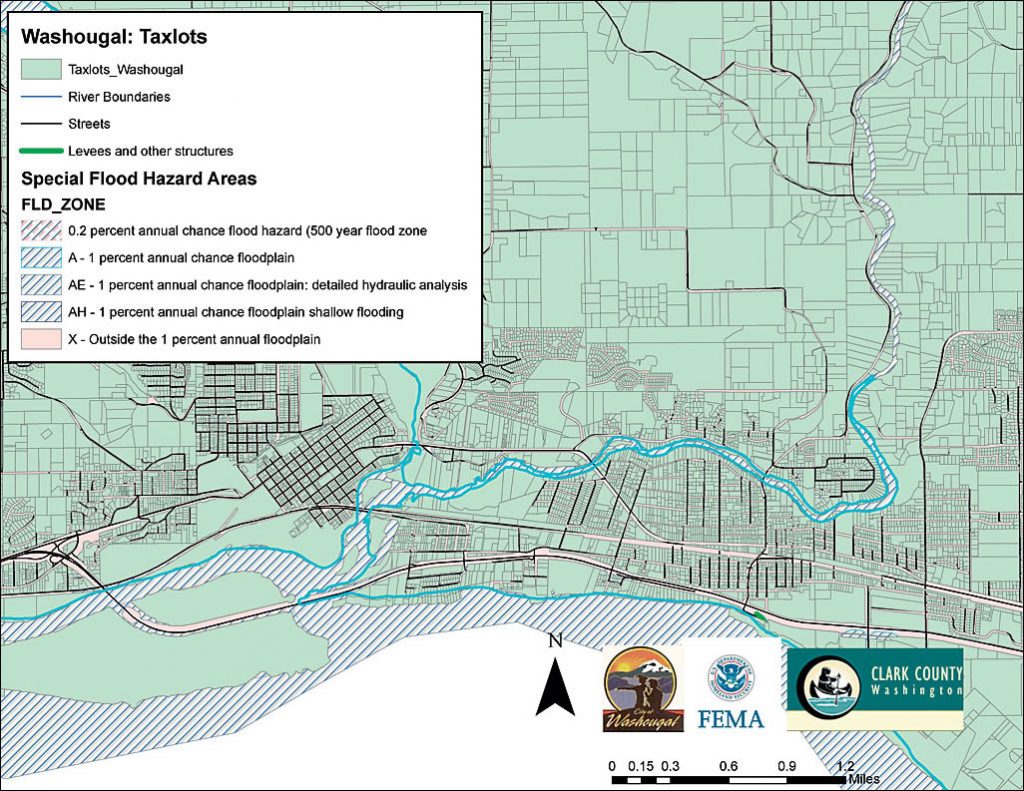

Wave runup was calculated using methods from the Shore Protection Manual (SPM), Technical Advisory Committee for Water Retaining Structures (TAW), and RUNUP 2.0 as described in the FEMA Guidelines and Specifications. These are the maps used by citizens, government, insurance agents and banks to determine whether flood insurance is required. While these data are provided for informational purposes, any data to be used for regulatory purposes should be obtained directly from FEMA. To help communities understand their risk, flood maps (Flood Insurance Rate Maps, FIRMs) have been created to show the locations of high-risk, moderate-to-low risk and undetermined-risk areas. 50 – Policy and Procedures for Identifying and Mapping Areas Subject to Wave Heights Greater than 1.5 feet as an Informational Layer on Flood Insurance Rate Maps (FIRMS)” (FEMA, 2008). Flood Insurance Rate Maps One-percent annual (100-year) flood boundary and 0.2-percent annual (500-year) floodplain boundaries adopted by FEMA and the NFIP. A limit of moderate wave action (LiMWA) was determined for all areas subject to significant wave attack in accordance with “Procedure Memorandum No.

#Flood insurance rate map software

Input data for the CHAMP analyses was calculated in standardized calculation worksheets developed using Mathcad software (Parametric Technology Corporation, 2007). Flood insurance rate zone determined by approximate methods, as no Base Flood Elevations (BFEs) are available for these areas. Overland wave heights were calculated for restricted and unrestricted fetch settings using the Wave Height Analysis for Flood Insurance Studies (WHAFIS) software, Version 4.0 (Divoky, 2007), within the Coastal Hazard Analysis for Mapping Program (CHAMP) Version 2.0 (FEMA, 2007b), following the methodology described in the FEMA Guidelines and Specifications for each coastal transect. The stillwater elevations for each transect were then linearly scaled based on a ratio between known stillwater elevations at adjacent gages and the Boston Harbor tide gage. The 10-year (10-percent), 50-year (2-percent), 100-year (1-percent) and 500-year (0.2-percent) annual-chance stillwater elevations were determined by performing a statistical analysis on nearby tidal gages as described in the “Regional Frequency Analyses using L-Moments” memorandum developed by STARR (STARR, 2010). Supporting files can be found in the digital data included in the coastal data submittal compiled per guidance in Appendix M (FEMA, 2011) of the FEMA Guidelines and Specifications. The coastal engineering analyses were performed using methodologies described in the “Atlantic Ocean and Gulf of Mexico Coastal Guidelines Update” (FEMA, 2007) to Appendix D, “Guidance for Coastal Flooding Analyses and Mapping” (FEMA, 2003), referenced hereafter as the FEMA Guidelines and Specifications. The coastal analysis establishes the flood elevations for selected recurrence intervals in the coastal area, namely the communities of Boston, Chelsea, Revere, and Winthrop. The purpose of this report is to summarize the coastal hydrologic and hydraulic analyses for the Suffolk County, Massachusetts, Digital Flood Insurance Rate Map (DFIRM) Study. Summary Report of Coastal Engineering Analyses

0 kommentar(er)

0 kommentar(er)