The awards granted lapse on their third anniversary to the extent that the performance criteria are not met. Awards are granted for nil consideration.

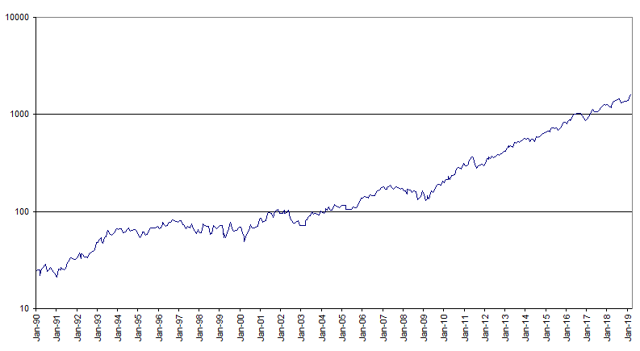

HALMA SHARES PRICE PSP

The total number of ordinary shares in issue (excluding shares held as treasury shares) is 378,020,857 shares.įollowing the vesting of the 2010 PSP awards, notification is given relating to PSP awards over Halma 10p ordinary shares granted on 6 August 2013 and vesting on 6 August 2016, subject to performance criteria. The purchased shares will not be subject to cancellation and will all be held as treasury shares in order to satisfy future awards under the Halma plc Performance Share Plan 2005 ('PSP').įollowing the above transactions, Halma plc holds 882,741 ordinary shares as treasury shares. Halma plc purchased 693,516 of its ordinary shares on 6 August 2013 through Investec Bank plc at the volume weighted average price for 5 August 2013 of 561.78 pence per share. Details are as set out below.Īfter the transactions set out above, the beneficial holdings of Directors and PDMRs, including family interests, in the 10p ordinary shares of Halma have increased as set out below. Further to the vesting, shares were sold on 6 August 2013, primarily to finance the associated tax liabilities, at 561.78 pence per share (the volume weighted average share price for 5 August 2013).

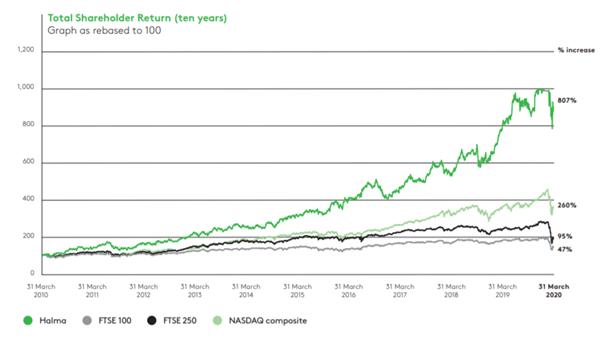

Notification is given relating to Performance Share Plan ('PSP') awards originally granted on 6 August 2010 and which vested on 6 August 2013 at 98.13% of the original award in accordance with the Rules of the PSP and the relevant performance criteria. In the short term, I expect Halma share price to remain below the 25-day EMA at 2,411 as the equities market remains under pressure.In accordance with 3.1.2R of the Disclosure Rules, notification is hereby given of transactions in the 10p ordinary shares of Halma by Directors and senior executives (persons discharging managerial responsibility 'PDMRs'), as follows: Halma is listed on the London Stock Exchange (LSE) and employs 7,000 staff. Over the last 12 months, Halmas share price has fallen by 0.57 from 2791p. In the week up to 13 June Halma shares plunged 9.94 to a closing position of 2002p. It helps investors to pick the best stocks, optimize their portfolios, and make smart data-driven. Halma plc (HLMA) is a publicly traded conglomerates business based in the UK. In fact, the stock is currently valued at £7,384m. Danelfin is a stock analytics platform powered by AI. A look at both the fundamentals and technicals presents a buying opportunity for long-term investors. Halma is one of just 200 UK-quoted stocks with a market capitalisation of more than £1 billion. On a daily chart, it is trading below the 25 and 50-day exponential moving averages.

To do that, its essential to look at the profile of the stock to see where its strengths are. The answer comes down to judging whether Halma is well placed to withstand economic shocks and ride out market volatility. Granted, it has since bounced off to 2,285 as at 09.04 a.m UTC. The stock was purchased at an average price of GBX 1,922 (23.33) per share, with a total value of 58,832.42 (71,407.23). Shares in Halma are currently trading at 2126.1 but a key question for investors is how the economic uncertainty caused by Covid-19 will affect the price. On Thursday, it dropped to 2,151 its lowest level since September 2020. Since hitting its all-time high of 3,272 GPX at the beginning of 2022, it has dropped by over 30%. Halma share price has been in the red for 8 consecutive weeks. The range between the high and low prices over the past day. Even with these M&As, its balance sheet remains healthy an aspect that further substantiates the bullish outlook for its stock in the medium to long term. It has acquired 53 firms 8 over the past 5 years. At the same time, Halma uses mergers and acquisitions as part of its growth strategy. However, as it continues to record a surge in revenues, it may experience some challenges in translating the observed growth into earnings. A look at the table above shows that Halma is a profitable firm.

0 kommentar(er)

0 kommentar(er)